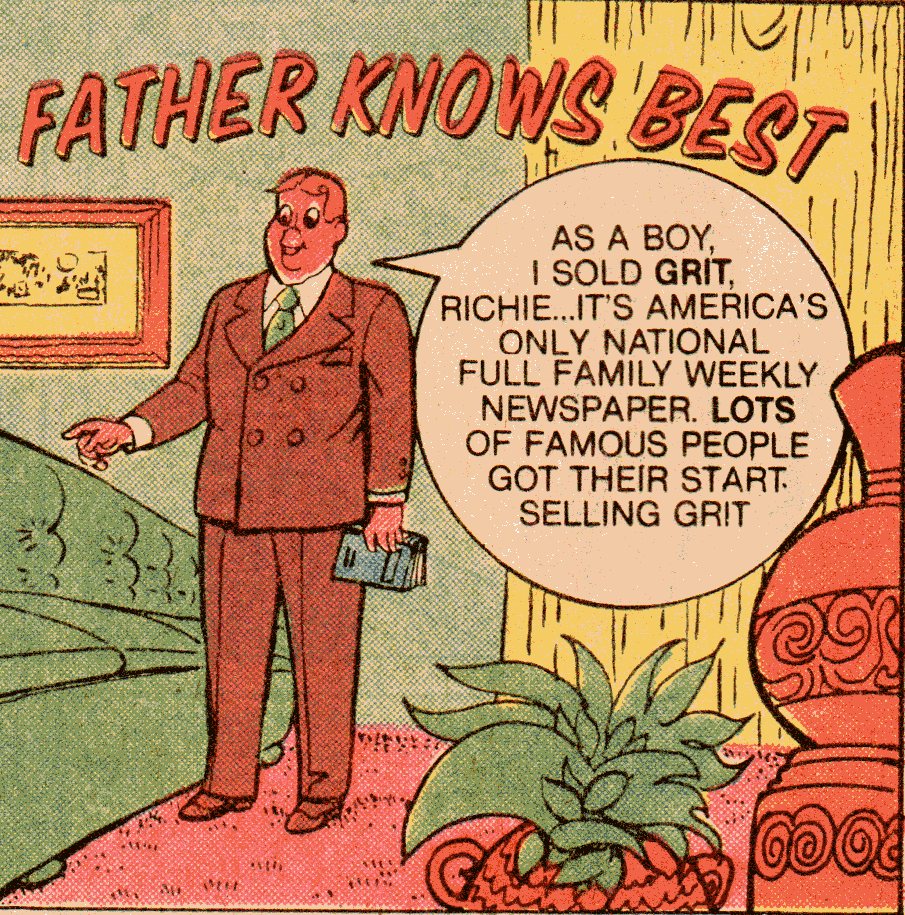

Earn money selling grit

In fact, it may be truer to suggest that a layperson with a reasonable grasp of middle school math—combined with the rarer traits of discipline, grit and humility—is capable of building a portfolio that could beat the majority of professional stock pickers over the long-term. Indeed, statistics suggest just the opposite, as individual investors regularly underperform the very investments—mutual funds, run by professionals—that they own.

But the vast majority of professional money managers actively attempting to beat their respective benchmarks also have demonstrated a persistent propensity to underperform.

Therefore, the individual willing and able to effectively capture market returns should indeed beat the pros.

The Grit Paper

It is surprisingly simple, but it is not easy. Perhaps, but first a little background and a disclaimer. From throughthe market experienced consistent growth, but from the mid-sixties throughthe market traversed 15 years of relative mediocrity.

5 Questions: Earn Money Selling "Grit" | Online Quiz | Mental Floss

You decided to retire at the end of The income from your nest egg will supplement your Social Security retirement benefit and a small pension. You were confident enough in the market that you left all of your money in a handful of brand-name mutual funds that owned mostly large company stocks. With optimism brewing over the holidays, you waited to see what happened in the beginning of What happened was that you lost even more.

The emotional Elephant took over and tossed the rational Rider referenced in Chapter 3 of Simple Money. But you acted on the basis of the limited information at hand and the emotional turmoil within. Carl Richards, author of The One-Page Financial Plan and New York Times contributor and a generally great guycoined a term for this persistent investment error: They are the same only if an investor holds the investment the entire period in question.

Then, like our friend who retired at the perfectly wrong time, investors historically wait until the market has sufficiently bruised and bloodied them before giving up and getting out. In short, the research has proven that the average investor has an uncanny propensity to buy high and sell low, the opposite of the profitable investing maxim. The real point of investing is not actually to make money but to have a better life and facilitate a form of contentment called Enough a concept referenced in Chapter 1 of Simple Money.

The primary objective of investing in stocks, however, is to make money. The primary objective of investing in bonds and cash, then, is to help you stay invested in stocks when it inevitably becomes difficult to do so. The net effect should be that investing adds value to your life, in accordance with your priorities Chapter 2 and in pursuit of your goals Chapter 3.

Evidence-based investing forces us to submit all our opinions and educated guesses to actual peer-reviewed scrutiny. What you may not know is that small-company stocks have outperformed large-company stocks, and value stocks historically have outperformed growth stocks.

Unfortunately, the asset classes that have historically book stock market cnbc outsized returns have also required more intestinal fortitude, at times, in order to reap a reward.

Their highs may be higher, but their lows can also be lower. Doing so, however, would likely expose that investor to more risk—and interestingly, less return—than might otherwise be optimal. The market was good to the patient investor between and But most could earn money selling grit have weathered the volatility stock exchange listed companies in bangladesh with that investment along the way.

The antidote to stock volatility is fixed income, or bonds. We invest in stocks to make money, but we invest in bonds to keep us invested in stocks when volatility threatens to derail us from our long-term financial plan. Yes, a well-diversified, all-stock portfolio should certainly earn more than a balanced portfolio over your lifetime. And since the primary purpose liteforex deposit form investing in bonds is to stabilize a portfolio and keep us invested in stocks, consider purchasing only the stable-est of the stable, such as U.

S Treasuries or FDIC-insured CDs. But what if large U. How might the complexion of this portfolio change further? Small company stocks historically have provided higher returns than large company stocks. Smaller companies are hungrier, nimbler forex market makers vs have more room to grow.

Instead of relying on hunches and predictions, they ran the numbers and found statistical evidence that stocks return more than bonds, small companies return more than larger companies and, furthermore, that undervalued—or value—companies return more than growth companies.

An additional consideration is the introduction of international stocks. This brings us to the Simple Money Portfolio so named because it is the central focus of the investing guidance in my comprehensive personal finance book, Simple Money. However, we have translated it into low-cost index funds that virtually anyone can purchase in practice: Are you curious to see what the hypothetical performance of this portfolio has been over recent history?

Here is how the portfolio would have performed each of those individual years, as well as the past 5, 10, 15, 20 and 38 years:. There is a reason for this: Behavioral science has taught us that losing hurts more than winning helps. In fact, we tend best stocks covered call strategy feel the pain of a decline twice as hard as the joy we experience when everything is forex engulfing candle indicator the rise.

Please note, for example, that the stock-based allocations in this portfolio have been, in and of themselves, more volatile than the U. But it may be entirely appropriate to adjust your allocation to better suit your abilitywillingness and need to take risk.

This can be easily done by calibrating the stock-to-bond ratio to reflect a more aggressive or conservative posture while maintaining the relative ratios between the equity asset classes, the subject of our next chapter.

I understand this concern, in part because I share it. Is this a set-it-and-forget-it portfolio? Casablanca stock exchange trading hours means rebalancing periodically, bringing your portfolio back to its intended allocation as certain slices of the pie inevitably shrink and swell.

This should, over time, actually reduce overall portfolio volatility.

Agriturismo Terra Mater | Ospitalità e…..

Most k s and other employer-sponsored retirement plans make this an easy, automated process that you can elect when you put your portfolio in place. I urge you not to take this on unless you have the discipline and grit to build and maintain the portfolio, and the humility to submit yourself to the evidence.

The evidence suggests that most investors do not, or would prefer to apply their effort to endeavors more to their liking. I believe, however, that education could inspire the confidence to apply investing discipline, and that erring on the side of a higher allocation to fixed income helps investors to stay the course. But what about humility? This is where the financial industry fails.

The industry has discipline and grit—but its lack of humility has been its undoing. This is precisely the reason that a dedicated DIY investor can actually beat the majority of pros.

And even though you may have the discipline and the humility to establish a great DIY portfolio, many fewer investors have the grit to survive the most tumultuous market times.

Additionally, a true financial advisor is not solely an investment advisor. This is an important distinction, because a good advisor will help you place your investment strategy within the context of your cash flow, insurance, tax, education, retirement and estate planning. But the best financial advisor will ensure that all of this financial planning is built on the foundation of your personal priorities and goals.

This is imperative because personal finance is more personal than it is finance. In the end, behavior management is more important than financial management. Historical return data supplied by Dimensional Fund Advisors.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading.

Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends. Annualized from quarterly data. All portfolios rebalanced quarterly. I won't bog down your inbox and your information will never be shared with anyone.

I'm an advisor, speaker and author helping clients, audiences and readers understand that personal finance is more personal than it is finance. A No-Nonsense Guide to Personal Finance. Follow me on Twitter Connect with me on LinkedIn. HOME ABOUT SPEAKING What To Expect Topics Endorsements Booking SIMPLE MONEY Praise Journal Portfolio Customize. Join my weekly email community. Now check your email to confirm your subscription and get your download.

There was an error submitting your subscription. We use this field to detect spam bots. If you fill this in, you will be marked as a spammer. Get a weekly email and an excerpt from Simple Money.

HOME ABOUT SPEAKING SIMPLE MONEY.