Outside bar trading forex

Outside bar candlestick patterns also know as engulfing patterns are major reversal signals when occurring during the context of a trending market. The pattern can be bullish or bearish depending on the preceding trend and the pattern also shows us that the market has expanded in the most recent period.

In the case of a bullish outside bar candlestick pattern we would see the market open lower than the previous close and close higher than the previous open.

Hence the term Engulfing pattern. The signal becomes even stronger when the opening price of the bullish outside bar pattern was lower than the previous days low and the closing price of the pattern was higher than the previous days high.

Price Action Trading Course (LEARN FOREX PRICE ACTION)

The bearish outside bar candlestick pattern has each of the characteristics of a bullish pattern but in reverse. We would see the market open higher than the previous close and close lower than the previous open.

The signal becomes even stronger when the opening price of the bearish outside bar pattern was higher than the previous days high and the closing price of the pattern was lower then the previous days low. The market has been committed to a trend but the most recent period has a small price range that signifies indecision.

The next period we see the price gap away from the previous closing price which makes the market presume that the trend is still intact. However, the gap is quickly filled and by the end of the period price has closed outside of the previous periods open.

The net result of this type of price action is that investors have been trapped into thinking that an existing trend is still in force but by the end of the period they realise that it is not. Remember that candlestick patterns are useful because they show us the prevailing sentiment of the investors who make up the market, when the outside bar candlestick pattern is formed we see that investor sentiment has been significantly altered.

As the outside bar pattern must be formed by a period which has a larger range than the preceding period we also see that the reversal in sentiment has more conviction than currently exists for the preceding trend. As ever, I must point out that many outside bar candlestick patterns will fail!

Sound risk management cannot be overstated. These are the rules to our outside bar trading strategy.

A a few weeks ago that was posted on our Twitter account. Being able to explain a trading method by way of an example that was called in real-time should help you gain confidence in it. A trade was made because it met each of our outside bar pattern rules and passed one of our fundamental check-lists and sector strength filter. As I have pointed out elsewhere though, entry signals are the least important aspect of a good trading system.

Forex Trading For Beginners

The most important rules are to do with risk management and exit strategies. A trade we had the following entry and exit rules:.

The one great benefit of having a specific set of rules to follow for your entry method is that you can easily program them into a screener. In less than 5 minutes a day you can then run your screener to only return stocks that meet your criteria. For instructions of how to do this using free software please watch the finviz screening tool tutorial in our tutorials section. Because we spend so little time searching for trades that meet our entry criteria we can focus our attention on the important aspects of money management and exit strategy.

To decide on the trade to take do the following…. Calculate the first profit target for each of the trades and choose whichever trade has a closer target compared to the next line of major resistance. Each example has met the same rules as our BT. If you were to get both of the outside bar candlestick patterns shown in the previous 2 charts on the same day you would take the trade in FORD.

The nearest point of major resistance on the chart is 1. By choosing the trade with the resistance further away there is more chance that other investors will buy into the reversal. When everyone around you would have been running for the hills you would have been patiently waiting for these types of pattern to short the market. While we have provided a simple trading strategy for you to follow there are countless other ways that you could incorporate outside bar candlestick patterns into a trading strategy.

Just leave a message in the comments area below. Thanks for your prompt reply. Sir, your research mainly deals with daily charts, but, I am a day trader and deals with 15 minute charts.

Can you suggest a way by which I can optimize indicators setting for 15 minute chart. For example, ROC value of period signifies one year for daily charts but is it useful for 15 minutes or I should optimize it in some manner.

I think most of your readers who are day trader like me want to ask. I do not use candlestick patterns on intraday timeframes. My research has found that what little edge there is in using candlestick patterns on the daily charts is totally lost when lowering the time-frame.

My advice would be to invest in a simulator such as ForexTester2 and to test the patterns using 15 minute charts. Blogs and books such as my own should be seen as educational and as a foundation to build from.

Not as the holy gospel. As for the value of ROC, I tend to keep roughly the same settings across multiple timeframes. Rather than optimizing the parameter used, I simply want it to tell me something basic. So if I were to use 15 min charts, I might want to know the weekly performance at a glance.

Presuming that you are trading equities, the ROC which would tell you a stocks weekly performance would be set to about Regardless of what you might read about online, be very sceptical about trading intraday charts with candlestick patterns. Disclaimer - Forex, futures, stock, and options trading is not appropriate for everyone.

There is a substantial risk of loss associated with trading these markets. Losses can and will occur. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. Nor will it likely ever be. No representation or implication is being made that using the BacktestWizard methodology or system or the information contained within any BacktestWizard material will generate profits or ensure freedom from losses.

SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. How to Trade Outside Bar Candlestick Patterns.

The period before the bullish outside bar pattern should also have closed lower than it opened.

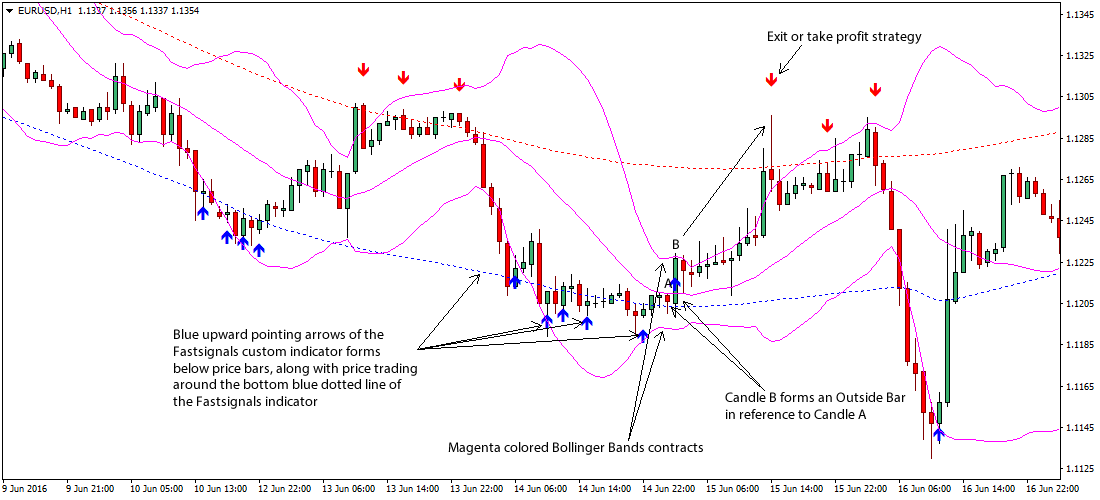

Outside Bar Forex Trading Strategy

This is what a perfect bullish outside bar candlestick pattern looks like: The period before the bearish outside bar pattern should also have closed higher than it opened.

This is what a perfect bearish outside bar candlestick pattern looks like: The Psychology That Creates Outside Bar Candlestick Patterns The market has been committed to a trend but the most recent period has a small price range that signifies indecision. Notice how the large range of the bullish outside bar pattern led to a strong reversal. Outside Bar Candlestick Pattern Trading Strategy As ever, I must point out that many outside bar candlestick patterns will fail! The stronger the existing trend has been, the greater the likelihood that an outside bar pattern will lead to a reversal.

The reason for this is that demand will dry up if everyone is already long and supply will dry up if everyone is already short. The rule being that bullish outside bar candlestick patterns can only be traded if the stochastic are oversold and the bearish outside bar candlestick pattern can only be traded if the stochastic are overbought.

If the bullish outside bar candlestick pattern closes in the top quarter of its range the signal is stronger. If a bearish outside bar candlestick pattern closes in the bottom quarter of its range the signal is stronger. Outside bar candlestick patterns that are created during a pull-back of an up-trend or a rally during a down-trend have a greater likelihood of success.

We will use a moving average filter to only allow us to trade bullish outside bar candlestick patterns in a long-term up-trend or bearish outside bar candlestick patterns in a long-term down-trend. We like to see the volume on an outside bar candlestick pattern being greater than the recent average because it indicates that any reversal might have a greater participation.

Outside Bar Candlestick Patterns Entry and Exit Rules The BT. A trade we had the following entry and exit rules: Buy 1 penny above the high of the bullish pattern.

A Forex Price Action Trader's Guide to Outside Bars - Trading Heroes

Initial Stop-Loss to be 2 x the value of an ATR indicator away from entry. The first profit target is 2 x the value of an ATR indicator away from entry. Half the position is closed at the first profit target. The stop-loss is then moved to break-even. The remaining half position has a trailing stop-loss 2 x the value of an ATR indicator behind each new high.

If the price makes 7 times the initial risk before being stopped out…manually close the trade. To decide on the trade to take do the following… Calculate the first profit target for each of the trades and choose whichever trade has a closer target compared to the next line of major resistance. Until next time, stay profitable! Sir, Thanks for your prompt reply. Llewelyn Reply February 10, Hi Apoorv, I do not use candlestick patterns on intraday timeframes.

I wish you the best of luck, Llewelyn. Leave A Response Cancel reply. Login to Members Area… Flagship Trading Course Home Page. Search For Financial Data. Recent Using PMI Data For Tactical Asset… 4 Comments Does an overbought Monthly RSI 14 … 2 Comments Applying a Sector Filter to a… 4 Comments Thanksgiving Day Football Picks 0 Comments The Elder Impulse System Amibroker 0 Comments.