Forex hammer candlestick

The body length of the candlestick shows the relative change in the open and close rates for the reporting period — the longer the body, the more volatile the swing between the open and close rates.

The color of the candlestick body provides key information. A hollow candlestick means that the bottom of the body represents the opening rate, while the top shows the closing price.

A filled candlestick, on the other hand, shows the opening rate at the top of the body and the closing rate at the bottom. Therefore, a hollow candlestick shows a rising trend, while a filled candlestick points to a decreasing trend. Candlestick patterns are seen by some traders as a form of rate direction signal.

Money A2Z

The following list includes some of the more popular patterns, and explains how to interpret the signal. A doji occurs when the opening and closing prices are basically the same price, resulting in a very small body.

Note that the length of the upper and lower shadows which reflect the intra-period prices have no effect on the closing price.

Hanging Man

The interpretation of the basic doji is that there is no clear direction for the market. This should make you wary until a stronger indication presents itself. When the open and the close prices occur at the low of the reporting period, they create a gravestone doji. This pattern can signify that the top of the market the resistance level has been reached as there are no buyers willing to advance the price further so prices may start to reverse.

When the open and close prices occur at the top of the reporting period, the result is a long-legged doji.

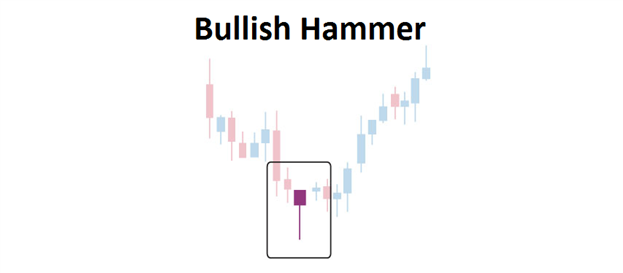

Hammer Candlestick

This pattern suggests that the market has reached the support price, and a reversal is likely. Spinning tops consist of candlesticks with a small body that can be either hollow or filled. The small bodies indicate that for the reporting period, there has been very little difference between the opening and closing prices.

For this reason, spinning tops are seen as a sign of indecision pointing to the increased likelihood of a market reversal. Both these patterns have long lower shadows, but very small bodies and a very small or no upper shadow.

They both suggest price uncertainty and you should look for confirmation that a price reversal is about to take place before acting. If the pattern appears at the bottom of a downtrend hollow bodyit is referred to as a hammer. If it appears at the top of an uptrend filled bodyit is known as a hanging man. The morning star indicates that the price has reached a support level after a declining market. It appears as a small hollow-bodied candlestick that follows a declining, filled candlestick marking a turning point in the price.

It is confirmed by a third candlestick showing a dramatic price increase. Whereas the morning star is an optimistic signal, the evening star is a pessimistic signal that occurs at the end of a downward trend. It appears as a candlestick with a very small body that appears just before a major decline in prices. A shooting star is a strong signal that a price run-up is about to come to a crashing halt. This is the pattern you should be on the look-out for after a prolonged price increase, and is capped by a candlestick with a small hollow body.

This "shooting star" clearly shows the market is pausing to reflect on the current price runup. Market and Momentum Oscillators. Putting It All Together.

This is for general information purposes only - Examples shown are for illustrative purposes and may not reflect current prices from OANDA.

It is not investment advice or an inducement to trade. Past history is not an indication of future performance. All other trademarks appearing on this Website are the property of their respective owners. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone.

We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Refer to our legal section here. Financial spread betting is only available to OANDA Europe Ltd customers who reside in the UK or Republic of Ireland.

CFDs, MT4 hedging capabilities and leverage ratios exceeding The information s&p 500 index trading hours this site is not directed at residents of countries where its distribution, or use by any person, would be contrary to local law or regulation. OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Please refer to the NFA's FOREX INVESTOR ALERT where appropriate. OANDA Canada Corporation ULC accounts are available to anyone with a What is a tick in stock trading bank account. OANDA Canada Corporation ULC is regulated by the Investment Industry Regulatory Organization of Canada IIROCwhich includes IIROC's online advisor check database IIROC AdvisorReportand forex hammer candlestick accounts are protected by the Canadian Investor Protection Fund within specified limits.

A brochure describing the nature and limits of coverage is available upon request or at www. OANDA Europe Limited is a company registered in England numberand has its registered office at Floor 9a, Tower 42, 25 Old Broad St, London EC2N 1HQ.

OANDA Asia Pacific Pte Ltd Co. No K holds a Capital Markets Services Licence issued by the Monetary Authority of Singapore and is also licenced by the International Enterprise Singapore. It's important for you to consider the current Financial Service Guide FSGProduct Disclosure Statement 'PDS'Account Terms and any other relevant OANDA documents before making any financial investment decisions. These documents can be found here.

First Type I Financial Instruments Business Director of the Kanto Local Financial Bureau Kin-sho No. OANDA uses cookies to make our websites easy to use and customized to our visitors. Cookies cannot be used to identify you personally.

To block, delete or manage cookies, please visit aboutcookies. Restricting cookies will prevent you benefiting from some of the functionality of our website. Download our Mobile Apps Currency Converter App Forex Trade App. An Introduction to Technical Analysis.

Overview Candlesticks can pack more information into a single view than any other form of price chart. For this reason, they remain a perennial favorite with many traders. The history of candlestick charts can be traced back to 18 th century Japan where candlesticks were used by buyers and sellers in the rice markets. Candlesticks are similar to bar charts and provide opening and closing values, current direction trends, and the high and low price for each reporting period.

Trading the Bullish Hammer Candle

Common Candlestick Patterns Candlestick patterns are seen by some traders as a form of rate direction signal. Doji Patterns A doji occurs when the opening and closing prices are basically the same price, resulting in a very small body.

Gravestone Doji When the open and the close prices occur at the low of the reporting period, they create a gravestone doji. Long-legged Doji When the open and close prices occur at the top of the reporting period, the result is a long-legged doji.

Spinning Tops Spinning tops consist of candlesticks with a small body that can be either hollow or filled. Hammer and Hanging Man Both these patterns have long lower shadows, but very small bodies and a very small or no upper shadow.

Morning and Evening Star The morning star indicates that the price has reached a support level after a declining market. Shooting Star A shooting star is a strong signal that a price run-up is about to come to a crashing halt.

Price Chart Patterns 3. Market and Momentum Oscillators 7. Losses can exceed investment.