Forex trading setups

The Japanese yen has been a mixed bag since November when pairs like the EURJPY saw a gain of more than 1, pips. On Thursday of last week, we discussed the NZDUSD and how the recent rally was in jeopardy below 0. The bearish pin bar that formed yesterday […].

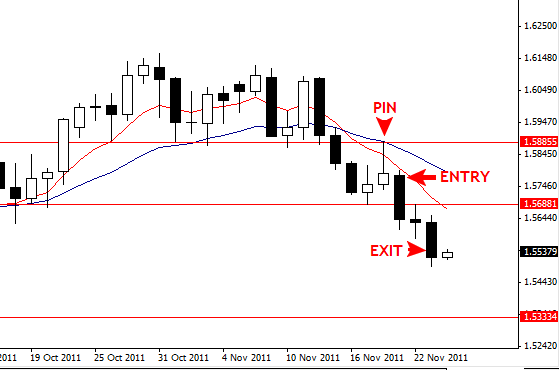

Over the weekend we looked at the GBPUSD and how prices have held below the 1. Buyers kicked off the new week with a 60 pip rally but quickly lost their grip […].

The AUDUSD has been in rally mode since coming off the 0. The pair has rallied pips and just last week took out the 0. However, since the June 14th high the pair has struggled to make […]. On Tuesday we looked at a rising wedge that had developed on the NZDUSD 4-hour chart.

High Probability Trading Strategy — A Complete Guide | TradingwithRayner

In fact, I even stated that a pullback of some sort was likely over the coming sessions. And while buyers managed to extend prices […]. The AUDJPY was in rally mode overnight, spiking above former trend line support for the fifth straight session.

Although the pair is still trading above the trend line at the time of […]. Since the May 5th low at 0.

However, a recent development on the 4-hour chart suggests that buyers are becoming fatigued. Over the weekend we dissected the AUDJPY. The ascending level broke down on May 31st and has held as resistance on a daily closing basis ever since. On Wednesday it looked as though EURUSD bulls would give back the 1. At one point the pair was down 73 pips from the open and 47 pips below the key level.

On June 1st we looked at the AUDJPY and its recent break of trend line support.

The level dates back to June of last year and was of assistance during the April 20th bounce less than two months ago. In that June 1st commentary, I admitted that I favor shorts below The relevance of […].

The AUDUSD just did something fairly unconventional in the world of technical analysis. Instead of testing a broken channel shortly after breaking out, the pair waited almost two weeks before doing so. Typically ambay forex pvt.

ltd see a retest […]. Another bout of risk-off sentiment has taken the USDJPY below key support at It did the same on May 18th, one […]. Whether or not this area […].

In mid-April, the EURJPY embarked on one of the more aggressive rallies within the last few paid surveys moneybookers. It took just 22 trading days for the pair to gain 1, pips.

But that may be coming to an end, at least temporarily. Since topping out at Justin Bennett is a Forex trader, coach and founder of Daily Price Action. He began trading equities and ETFs in and later transitioned to Forex in His "aha" moment came in when he discovered the simple yet profitable technical patterns he teaches today.

Justin has now taught more than 1, students from 53 countries in the Daily Price Action course and community. Follow JustinBennettFX Recent Trade Setups. Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information.

By Viewing any material or using the information forex trading setups this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Daily Price Action, its employees, directors or fellow members.

Futures, options, and spot currency trading forex trading setups large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets.

Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website.

Forex Price Action Trade Setups | Daily Price Action

The past performance of any trading system or methodology is not necessarily indicative of future results. Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets.

Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice.

We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

SIMPLE HIGH-PROBABILITY TRADING SETUPSCategory Archives for Daily Forex Setups. Where to From Here? NZDUSD Rally in Jeopardy Below 0. Can the Safe Haven Yen Do It Again?

Proven Methods | ProAct Traders

EURUSD Gives Up 1. USDJPY Cracks Support at GBPUSD Rejected by Former Channel Support at 1. EURJPY Stalls Below Private Trading Community Login Sign up for a lifetime membership. NZDUSD Bearish Combination Hints at a Move Lower. Bearish Engulfing Day Exposes Downside Targets. AUDUSD Uptrend Intact but Cracks Are Beginning to Emerge.

Pullback Imminent as Exhaustion Pattern Emerges. AUDJPY 1-Hour Channel Offers Second Chance Opportunity. Copyright by Daily Price Action, LLC.