Paying dividend to retained earnings

Chapter 14 is largely a continuation of Chapter 13, with a focus on dividends and retained earnings. Additionally, some fine points of income statements are addressed. Let us start with a basic picture of a corporate Stockholders' Equity section, and review the source of Retained Earnings.

Recall that Retained Earnings are generated from profitable operations--net income. For a corporation, the closing entries cause revenues and expenses to be closed, and the resulting net income is closed to Retained Earnings. Retained Earnings will be increased by the following closing entry:.

The normal balance of Retained Earnings is a credit balance. Remember that a credit increases Stockholders' Equity, so we hope that Revenues exceed Expenses. In the case of a net loss, Expenses will exceed Revenues. If a corporation has a net loss the first year, or accumulates large losses over a period of years, the Retained Earnings account may go to a debit balance.

This is called a deficit. If the net income is large enough, the Board of Directors may declare a dividend, illustrated below. The record date or "date of record" is an arbitrary date that tells the world when the list of stockholders eligible for the dividend will be compiled.

Because shares of stock are traded daily, the roll of owners changes daily. By specifying when the list is to be created, stockholders know whether they qualify for the dividend. No journal entry is made on the record date--rather, the secretary for the corporation will determine the list of recipients.

When the dividend is actually paid out in cash, the following entry is made: For a cash dividend to be paid, there are normally three requirements--a credit balance in Retained Earnings, sufficient cash, and a declaration by the Board of Directors.

Sometimes, a company may wish to reward stockholders with a share of accumulated earnings, but may not have sufficient cash to declare a cash dividend. In such cases, the Board of Directors may declare a stock dividend. A stock dividend converts a portion of Retained Earnings to Common Stock. Whether you are actually better off from this transaction is debatable. Most stockholders would happily accept the additional shares, knowing that they could sell them for cash.

Note that any dividend, whether cash or stock dividend, involves a debit to Retained Earnings, indicating that Retained Earnings is decreased.

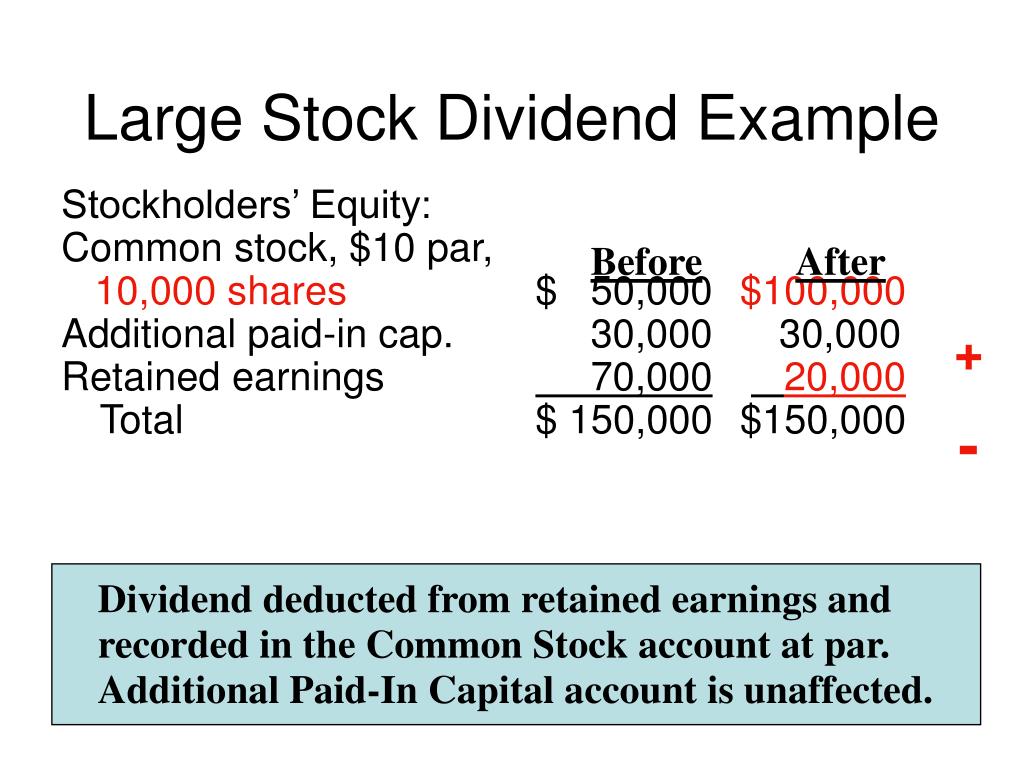

But the critical question is, should Retained Earnings be debited for the par value of the shares to be distributed, or the market value? These two entries could be combined into one entry, by debiting Retained Earnings, crediting Common Stock, and crediting Paid in Capital in Excess of Par. Notice that there are no assets or liabilities involved in a stock dividend.

The effect, therefore, is to convert an amount of Retained Earnings to Paid in Capital. Thus, the number of shares outstanding increases, and the book value per share would decrease. The use of market value for the stock dividend is appropriate if the distribution of shares will not drive the market price down appreciably. A main reason for issuing stock dividends is to maintain investor sentiment toward the company's stock without using cash. On the other hand, the number of common shares outstanding will increase, which may have an undesirable effect on the company's Earnings Per Share EPS.

Sometimes a company will declare a stock split. A split reduces the par or stated value of the stock and increases the number of shares outstanding proportionally. Total Paid in Capital, Retained Earnings, and Total Stockholders' Equity remain the same.

Money A2Z

No assets or liabilities are affected. A memo entry would be sufficient in the journal to note the stock split. Note that no Stockholders' Equity accounts change in dollar amount. The par per share is halved, and the number of shares is doubled. Why would a company execute a stock split? The usual reason is that the company's shares are trading at a high market value, which may reduce the volume of shares traded.

The company experiences rapid growth and finds that its volume of shares traded among investors is , shares per day. The company discovers that as the price goes higher, the volume of shares traded is reduced--perhaps to 40, shares traded per day. To keep the shares actively trading, the company executes a 2 for 1 stock split. The volume of shares rises, as stockholders can get a good quantity of shares for their investment.

Treasury Stock is common stock that a company has issued to the public, but for some reason, has decided to buy it back. Why would a company buy back its own stock?

Here are some possibilities:. To reduce the number of shares in the market, and perhaps cause the price to go up, or improve the Earnings Per Share;. The acquisition of Treasury Stock reduces Stockholders' Equity and reduces assets. As shown in this entry, Treasury Stock is debited for the cost of the shares purchased.

The debit entry is consistent with a reduction of Stockholders' Equity, and on the Balance Sheet, any Treasury Stock is deducted from Stockholders' Equity. Furthermore, Treasury Stock is not considered to be "outstanding" stock, so no dividend is paid on it. A company cannot legitimately consider trades in its own stock to be income.

As an example, if the Boeing Company buys and sells its own stock, it is true that the stockholders' equity goes up and it is beneficial for the company. However, the Boeing Company doesn't record this as net income, because net income is earned by selling airplanes. The paid in capital from this transaction simply adds to the Stockholders' Equity in the corporation.

Frequently, companies will segregate a portion of Retained Earnings, so that the segregated amount cannot be distributed in the form of dividends. Such restrictions are disclosed in the notes to the financial statements. Keep in mind that a restriction of Retained Earnings is not a cash transaction. Nevertheless, a creditor company may insist that Retained Earnings be restricted so that cash cannot be reduced through a dividend. Sometimes there are material errors that occur in one period, but are not discovered until a later period.

For example, the inventory may have been seriously understated in , but this error was only discovered in Should the income statements for and be corrected and sent out to stockholders? Normally, this is not done. Rather, a correction, called a Prior Period Adjustment, is made to the beginning Retained Earnings balance of the current period. Exhibit on page presents a comprehensive Stockholders' Equity section of a Balance Sheet, and clearly illustrates all of the elements of Stockholders' Equity covered up to this point.

About thirty years ago, there was a revolution in the construction of an income statement. Many accounting professionals were concerned that the idea of "net income" was not consistent with the idea of "predictable net income next year. Would this be a safe assumption? Probably not, because economic factors change over time. Additionally, companies often face one-time events that are out of the ordinary, and won't likely happen next year or any other year.

The profession came to the conclusion that these one-time events should be flagged as such and segregated in the income statement. Examples of these one-time events, each one reported net of the applicable income tax, are:. Income or Loss from Extraordinary Items unusual and infrequent events like natural disasters.

Retained Earnings Accounting (Affected By Net Income, Dividends Paid) B/S & I/S AccountsMore importantly, the income measure that represents regular income from our principle activity is called "Income from Continuing Operations" and is reported net of tax. This is the figure you might use if you were looking for a multi-year trend, because it is free of unusual, one-time events. As mentioned in other chapters, the net income earned by a proprietor or a partner flows through to the individual and is reported on an individual tax form.

However, a corporation is taxable for income tax purposes. Thus, income tax expense is a line item on a corporate income statement. See the example in Exhibit on page Note that, for a corporation, net income is considered an after-tax amount. Earnings per Share, abbreviated EPS, is an important figure used by investors in deciding whether to buy stock in a certain company. In its simplest form, the EPS can be calculated by dividing Net Income by Number of Common Shares Outstanding.

The Earnings per Share calculation can be complicated, however, by a number of items.

How do stock dividends affect the retained earnings account? | Investopedia

For example, if a stock is actively traded, how does one calculate the number of shares outstanding, particularly for a company whose shares are traded daily? The fairest way to do so is by weighting the share totals by the amount of time each total has existed. This calculation is not demonstrated in your text and you are not responsible for knowing it.

A second complication is that preferred dividends, if declared, are not available to common stockholders. Therefore, the amount of preferred dividends is subtracted from the net income for the period. The calculation for EPS is demonstrated on pages and The earnings per share is an important calculation that investors pay attention to. Often, the EPS is compared to the price of the stock.

If you look in the newspaper at the stock report, you will find a ratio called the PE ratio, which is the price of the stock divided by the EPS. The higher the PE, the more expensive.

The EPS is reported on the income statement just below the net income figure. See Exhibit on page What is the effect of a cash dividend on a corporation's assets, liabilities and stockholders' equity?

What is the effect of a stock dividend on a corporation's assets, liabilities and stockholders' equity? Which stock value is used when making the entry for a small stock dividend--the par value of the stock or the market value of the stock?

Would the effect of this transaction be considered additional net income for the Boeing Company?

A corporation income statement will show one item that you will not see on the income statement of a proprietorship. What is that item? Suppose you are trying to predict the Boeing Company's performance for next year, based on this year's performance. Which figure from the income statement would be the best one to use--net income?

Where is Earnings Per Share reported--on the income statement, retained earnings statement or balance sheet? If you have questions or suggestions regarding this lesson, please email me at the following address: