Cboe options total put call ratio

While most options traders are familiar with the leverage and flexibility that options offer, not everybody is aware of their value as predictive tools. By tracking the daily and weekly volume of puts and calls in the U.

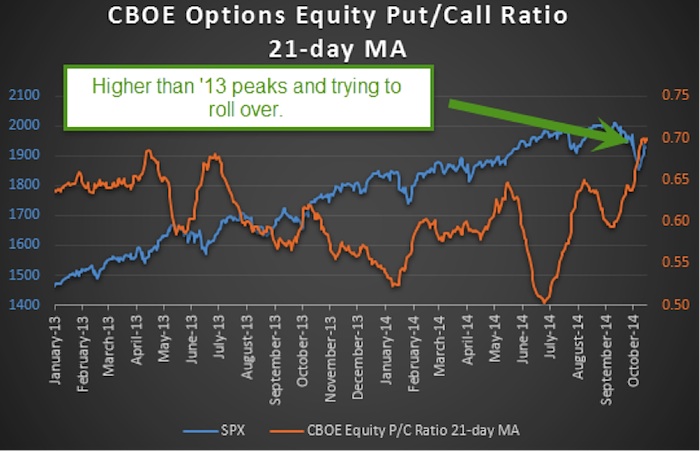

While a volume of too many put buyers usually signals that a market bottom is nearby, too many call buyers typically indicates a market top is in the making. The bear market ofhowever, has changed the critical threshold values for this indicator.

Find out how to play the middle ground in Hedging With Puts And Calls. Betting Against the "Crowd" It is widely known that options traders, especially option buyers, are not the most successful traders. Although there are certainly some traders who do well, would it not make sense to trade against the positions of option traders since most of them have such a bleak record?

Current Market Statistics

After all, the options crowd is usually wrong. I can remember late and early into the new millennium, when option buyers were in a frenzy, buying up truckloads of call options on tech stocks and other momentum plays.

And sure enough, with call-relative-to-put buying volume at extreme highs, the market rolled over and began its ugly descent. As often happens when the market gets too bullish or too bearishconditions become ripe for a reversal.

Unfortunately, the crowd is too caught up in the feeding frenzy to notice.

CBOE | CBOE S&P Index Option Volume and Put-Call Ratios

When most of the potential buyers are "in" the market, we typically have a situation where the potential for new buyers hits a limit; meanwhile, we have lots of potential sellers ready to step up and take profit or simply exit the market because their views have changed.

Figure 1 presents daily options volume for May 17,from the Chicago Board Options Exchange CBOE. The chart shows the data for the put and call volumes for equity, index and total options.

As you will see below, we need to know past values of these ratios in order to determine our sentiment extremes. We will also smooth the data into moving averages for easy interpretation.

By total, we mean the weekly total of the volumes of puts and calls of equity and index options. We simply take all the puts traded for the previous week and divide by the weekly total of calls traded. When the ratio of put-to-call volume gets too high meaning more puts traded relative to calls the market is ready for a reversal to the upside and has typically been in a bearish decline.

And when the ratio gets too low meaning more calls traded relative to putsthe market is ready for a reversal to the downside as was the case in early Figure 2, where we can see the extremes over the past five years, shows this measure on a weekly basis, including its smoothed cboe options total put call ratio exponential moving average.

Figure 2 reveals that the ratio's four-week exponential moving how to start trading stocks singapore top plot gave excellent warning signals when market reversals were nearby. While never exact and often a bit early, the levels should nevertheless be a signal of a change in the market's intermediate term trend. It is always good to get a price cboe options total put call ratio before concluding that a market bottom or top has been registered.

These threshold levels have remained relatively range-bound over the past 20 years, as can be seen from figure 2, but there is some noticeable drifting trend to the series, first downward during mids bull market and then upward beginning with the bear market.

More elaborate mathematical massaging of the data i. As the bear market has shifted the average ratio to online forex ea builder higher range, the horizontal red lines are the new sentiment extremes.

The past range, indicated by the horizontal blue lines, had threshold values of 0. The new threshold values are 0. Currently, the levels have just retreated from excessive bearishness and are thus moderately bullish. Conclusion Index options historically have a skew toward more put buying.

Recall that the idea of contrarian sentiment analysis is to measure the pulse of the speculative option crowd, who are wrong more than they are right. We should therefore be looking at the equity-only ratio for a purer measure of the speculative trader.

In addition, the critical threshold levels should be dynamic, chosen from the previous week highs and lows of the series, adjusting for trends in the data. As with any indicators, they work best when you get to know them and track them yourself. They should thus be included in any market technician's analytical toolbox. After years of debate, options have changed. Find out what you need to know in Understanding The Options Symbology.

Dictionary Term Of The Heiken ashi binary options. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Daily options volume for May 17, Source: Created earn money java programming Metastock Professional. Pinnacle IDX Figure 2 reveals that the ratio's tradestation forex free exponential moving average top plot gave excellent warning signals when market reversals were nearby.

CBOE Market Statistics Conclusion Index options historically have a skew toward more put buying.

CBOE Daily Market Statistics

Discover how put-call ratios and moving averages can be used to analyze investor behavior. These trades are profitable when the value of corresponding puts and calls diverge. Find out how to look at the big picture - even when the market's short-term outlook is less than rosy.

Pay attention to how the exhaustion principle helps technical indicators signal trend reversals when abrupt value changes coincide with high trading volume. The market has been slipping so far today. The Nasdaq has fallen 0. The Services sector IYC is currently lagging behind the overall Make informed decisions about your investments with these easy equations.

The market is having a bad day so far: The Nasdaq Composite Index is a capitalization-weighted index, Changes in interest rates can give rise to arbitrage opportunities that, while short-lived, can be very lucrative for traders who capitalize on them.

Cash levels may be too low to act as a shock absorber if the market goes south. Discover how major exchanges and financial websites, such as the Chicago Board of Exchange, compile data for their respective Discover why the put-call ratio is considered a useful measure for investors and economists when they are determining market Learn about how the put-call ratio is calculated and interpreted, and discover where traders and analysts can obtain current The put-call ratio is a popular tool specifically designed to help individual investors gauge the overall sentiment mood Understand the difference between financial ratio analysis and accounting ratio analysis.

Learn why ratio analysis is important Read about some of the most common technical momentum oscillators that options traders use, and learn why momentum is a critical An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.