The seller of a european call option has the

You must have javascript enabled to view this website. Please change your browser preferences to enable javascript, and reload this page.

The correct answer for each question is indicated by a. A The abandonment option on an investment project B Stand-by underwriting C A and B D The company's option to redeem its bonds at a premium before maturity 2 Which of the following investors would be happy to see the stock price rise sharply?

A An investor who owns a call option B An investor who owns a put option C An investor who owns the stock and has sold a call option D An investor who has sold a call option 3 Suppose an investor sells a put option. What will happen if the stock price on the exercise date exceeds the exercise price?

A The seller will need to deliver stock to the owner of the option B The seller will be obliged to buy stock from the owner of the option C The owner will not exercise his option D None of the above 4 Suppose an investor buys one share of stock and a put option on the stock. What will be the value of the investment on the final exercise date if the stock price is below the exercise price?

A The value of two shares of stock B The value of one share of stock plus the exercise price C The exercise price D The value of one share of stock minus the exercise price 5 A put option gives the owner the right A And the obligation to buy an asset at a given price B And the obligation to sell an asset at a given price C But not the obligation to buy an asset at a given price D But not the obligation to sell an asset at a given price 6 The buyer of a call option has the choice to exercise, but the writer of the call option has: A The choice to offset with a put option B The obligation to deliver the shares at exercise C The choice to deliver shares or take a cash payoff D The choice of exercising the call or not 7 Suppose an investor buys one share of stock and a put option on the stock and simultaneously sells a call option on the stock with the same exercise price.

Option style - Wikipedia

What will be the value of his investment on the final exercise date? A Above the exercise price if the stock price rises and below the exercise price if it falls B Equal to the exercise price regardless of the stock price C Equal to zero regardless of the stock price D Below the exercise price if the stock price rises and above if it falls 8 A call option that can be exercised only on one particular day is called A A European call B An American call C A short call D None of the above 9 The higher the exercise price: A The higher the call price B The lower the call price C Has no effect on call price D The higher the stock price 10 Which of the following features increase s the value of a call option?

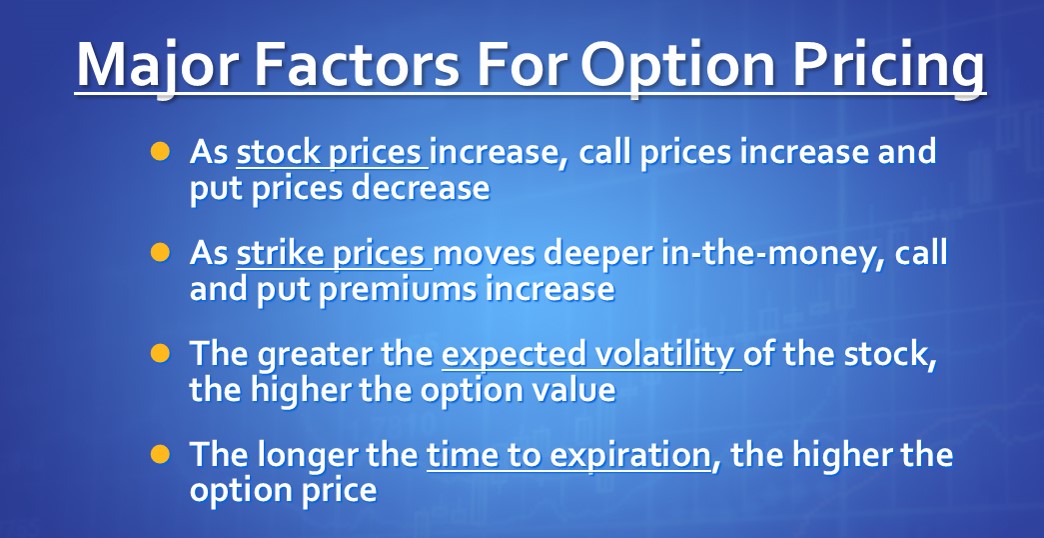

A A high interest rate B A long time to maturity C A highly variable stock price D All of the above 11 If the volatility of the underlying asset decreases, then the: A Value of the put option will increase, but the value of the call option will decrease B Value of the put option will decrease, but the value of the call option will increase C Value of both the put and call option will increase D Value of both the put and call option will decrease 12 Which of the following statements is true?

A Stock Price B Interest Rate C Time to expiration D Exercise Price 15 Put-call parity implies: Log In You must be a registered user to view the premium content in this website. If you already have a username and password, enter it below. If your textbook came with a card and this is your first visit to this site, you can use your registration code to register. Site Preferences Log out click here. Notes What is this? Add a note 1. None Yellow Red Green Blue 4.

This site The web PowerSearch. Course-wide Content Glossary Interactive FinSims Additional Appendices Related Websites PV Tables Choose a Chapter Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 16 Chapter 17 Chapter 18 Chapter 19 Quizzes Multiple Choice Quiz More Resources Excel Templates.

Instructor Resources Instructor Excel Templ Guide to Interactive F MiniCase Solutions PowerPoint Presentations Test Bank Digital Image Library Course-wide Content Glossary Interactive FinSims Additional Appendices Related Websites PV Tables Choose a Chapter Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 16 Chapter 17 Chapter 18 Chapter 19 Instructor Resources Instructor's Manual Solutions Manual Quizzes Multiple Choice Quiz More Resources Excel Templates.

Multiple Choice Quiz See related pages. Which of the following investors would be happy to see the stock price rise sharply? Suppose an investor sells a put option. Suppose an investor buys one share of stock and a put option on the stock. A put option gives the owner the right.

The buyer of a call option has the choice to exercise, but the writer of the call option has:. Suppose an investor buys one share of stock and a put option on the stock and simultaneously sells a call option on the stock with the same exercise price.

Call option - Wikipedia

Above the exercise price if the stock price rises and below the exercise price if it falls. A call option that can be exercised only on one particular day is called. The higher the exercise price:. Which of the following features increase s the value of a call option? If the volatility of the underlying asset decreases, then the:.

Multiple Choice Quiz

Value of the put option will increase, but the value of the call option will decrease. Value of the put option will decrease, but the value of the call option will increase. Which of the following statements is true? For both calls and puts an increase in the exercise price will cause an increase in the option price. For both calls and puts an increase in the time to maturity will cause an increase in the option price.

For calls, but not for puts, an increase in the time to maturity will cause an increase in the option price.

For puts, but not for calls, an increase in the time to maturity will cause an increase in the option price. The price of an option increases with an increase in all of the following except:.

To learn more about the book this website supports, please visit its Information Center. McGraw-Hill Higher Education is one of the many fine businesses of The McGraw-Hill Companies.

You must be a registered user to view the premium content in this website. None Yellow Red Green Blue. Glossary Interactive FinSims Additional Appendices Related Websites PV Tables. Choose a Chapter Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 16 Chapter 17 Chapter 18 Chapter MiniCase Solutions PowerPoint Presentations Test Bank Digital Image Library.

Instructor's Manual Solutions Manual.