Call option expected return

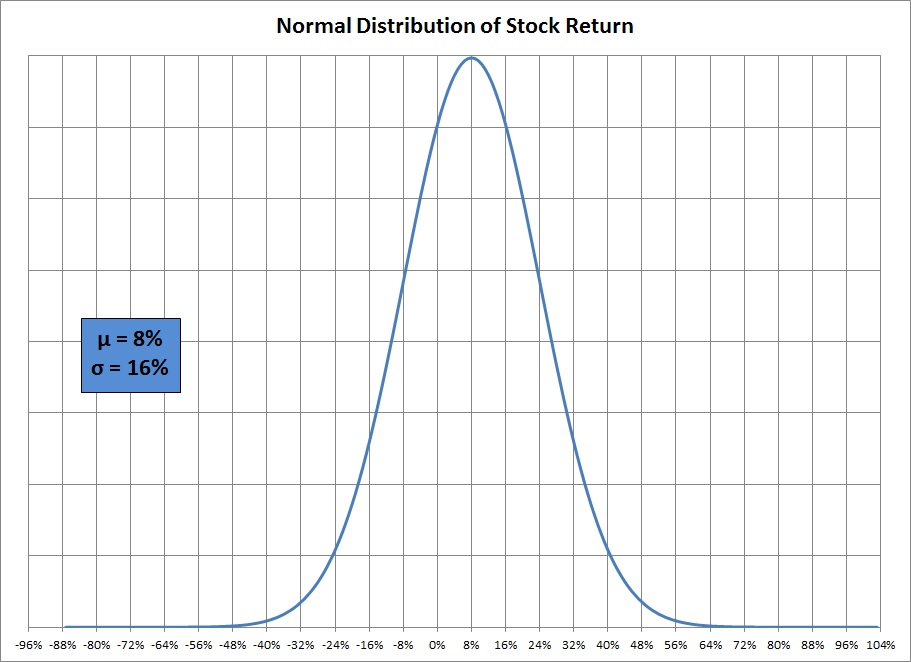

A call option is a financial contract that allows the holder to buy or sell an asset, if she so desires, at a predetermined price on a particular date. Options are one of the most volatile instruments: It is, therefore, critical to understand how to calculate the expected profit from an option.

An option is a financial contract that allows the holder to lock in a future price for a financial transaction. A call option gives the holder the right, but not the obligation, to buy a specific quantity of an asset at predetermined terms. A put option gives the holder the right, but once again, not the obligation, to sell a fixed quantity of an asset at a specific price and a particular date.

Option Workbench - Option Trading Analysis Software | Option Strategist

The price at which the option holder can execute a trade is referred to as the strike price. The date on which the trade will take place, if the option holder wishes, is known as the expiration date. While you, the option holder, can elect to exercise this option or not to use this privilege, the option's seller -- also referred to as the writer -- must sell you the stock if you so desire.

How to Buy A Call Option, Buying Call Options Examples

The option holder always pays the option seller to obtain the privilege of deciding whether to exercise the option. A call option is worth something at the expiration date, only is the asset's market price exceeds the strike price.

Investors purchase call options if they are bullish on the underlying asset; in other words, if they think that the asset's price will advance.

After all, it's cheaper to ignore the option and purchase Citibank at prevailing prices in the stock market -- for 50 cents less per share. The expected return on a call option equals: Options are risky financial instruments and must be approached with caution. Option Basics An option is a financial contract that allows the holder to lock in a future price for a financial transaction. Expected Return The expected return on a call option equals: Exercising Stock Options Tax Guide for Investors: How to Calculate a Stock Option Break-Even Point How to Determine the Break-Even Point of a Call Option What Does It Mean to Exercise Stock Options?

What Happens to a Stock Option if It Is Expired and You Don't Exercise It?

Strategies for Trading During Options Expiration Week Do You Get a Dividend if You Own the Option? Stock Options Explained in Plain English How Does the CBOE Volatility Index Work? Bull Put Spread Vs. Can You Sell Call Options You Purchased?

Call Option vs Put Option - Difference and Comparison | Diffen

More Articles You'll Love. Stock Options Explained in Plain English. How Does the CBOE Volatility Index Work? How to Buy Options if You Don't Own Stock. The Risk of Buying Call Options.

10. How to Price Options Based on Implied and Historical VolatilityHow to Calculate a Stock Option Break-Even Point. How to Determine the Break-Even Point of a Call Option. What Does It Mean to Exercise Stock Options? Strategies for Trading During Options Expiration Week.

Do You Get a Dividend if You Own the Option? How Does a Put Option Work? About Us Careers Investors Media Advertise with Us Check out our sister sites. Privacy Policy Terms of Use Contact Us The Knot The Bump.