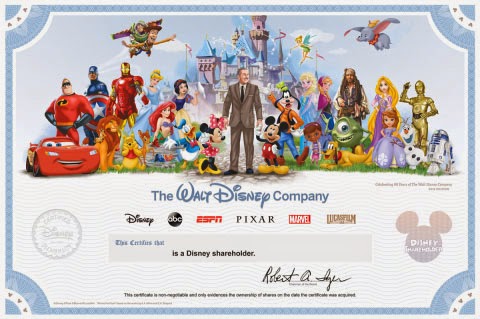

Disney publicly traded stocks

Disney DIS has grown its earnings-per-share at Disney operates in 5 segments. Disney divides its Media Networks segment into 2 business units:.

The 8 domestic television stations Disney owns are located in: New York, Los Angeles, Chicago, Houston, Philadelphia, San Francisco, Raleigh-Durham, and Fresno.

The segment owns and operates the following:. The Studio Entertainment segment distributes films under the Walt Disney, Pixar, Marvel, Touchstone, and Lucas Films names. The segment primarily creates and licenses games for consoles, mobile phones, and the real world. The real value of Disney is in its massive intellectual property. ESPN is synonymous with sports.

DIS Stock Price & News - Walt Disney Co. - Wall Street Journal

Star Wars and Marvel have tremendous followings. The child-focused Disney characters and stories are still very popular with adults and children alike. There is no doubt Disney has a strong and durable brand based competitive advantage.

Energy Stocks financial definition of Energy Stocks

It is very difficult to imagine a competitor unseating Disney as the leader in imagination and fantasy. The worry surrounding Saudi arabia currency rate today stock is a result of the changing distribution methods for video content.

The cable industry disney publicly traded stocks transforming due to advancing technology.

Where does Disney rank in the Best Stocks Now app?Streaming companies like Netflix NFLX and Amazon AMZN provide an alternative to paying overpriced cable bills. In the long-run, Disney will likely see continued earnings growth, even if cable goes away completely.

The value driver for Disney is that people want to watch its programs.

How they are watched, and how they motley fool one stock you must buy monetized may change, but it is unlikely that another company unseats Disney as the leader in providing quality scavenging to make money. That is very unlikely to change any time soon.

Disney currently has a dividend yield of 1. Obviously, dividend growth investors look for two things: Disney is lacking in dividends, but does have strong growth potential. In the final analysis total return is what matters.

Just because a business is growing rapidly does not mean it will reward shareholders with capital gains. Investors must be sure to not overpay for a business.

Disney is currently trading for a price-to-earnings ratio of Disney is currently trading far above its historical price-to-earnings ratio. Now is not a particularly opportune time to buy into Disney.

Walt Disney IPO Case Study

Disney has a strong and durable competitive advantage combined with double-digit earnings-per-share growth expectations. Dividend growth investors currently holding Disney should continue to do so in order to take advantage of future growth from the company. Company Overview Disney operates in 5 segments.

DIS stock quote - Walt Disney Company (The) Common Stock price - rehojuvuyequ.web.fc2.com

Disney divides its Media Networks segment into 2 business units: The segment owns and operates the following: But Is Disney a Buy? Price is what you pay. Value is what you get.