Stock split market efficiency

REIT Stock Splits and Market Efficiency | SpringerLink

This service is more advanced with JavaScript available, learn more at http: The Journal of Real Estate Finance and Economics.

An analysis of real estate investment trust REIT stock splits is presented.

Evaluation of the initial reaction to split REITs supports efficient market pricing where REITs generate statistically significant positive announcement date returns, no statistically significant record date returns, and muted ex-date returns. In the long-term, split REITs do not consistently out perform benchmark portfolios over one-year, two-year, and three-year periods.

Making Sense Of Market Anomalies

REITs split subsequent to a substantial run up in stock price and to improve the position of their post split stock price relative to the stock price of the typical REIT. Part of Springer Nature.

Not logged in Not affiliated REIT Stock Splits and Market Efficiency. Original Article First Online: Cite this article as: J Real Estate Finan Econ Underreaction or Market Friction? Department of Finance and Economics Mississippi State University Mississippi State USA 2.

Department of Finance and Economics Mississippi State University Mississippi State USA 3. Department of Accounting and Finance Alabama State University Montgomery USA.

STOCK SPLITS AND THE EFFICIENCY OF THE NIGERIAN STOCK MARKET on JSTOR

Publisher Name Kluwer Academic Publishers Print ISSN Online ISSN X About this journal Reprints and Permissions. Source Sans Pro, Helvetica, Arial, sans-serif; font-size: Unlimited access to the full article Instant download Include local sales tax if applicable.

Get Access to The Journal of Real Estate Finance and Economics.

Learn about institutional subscriptions. RIS Papers Reference Manager RefWorks Zotero. BIB BibTeX JabRef Mendeley.

Efficient-market hypothesis - Wikipedia

Share article Email Facebook Twitter LinkedIn. Cookies We use cookies to improve your experience with our site.

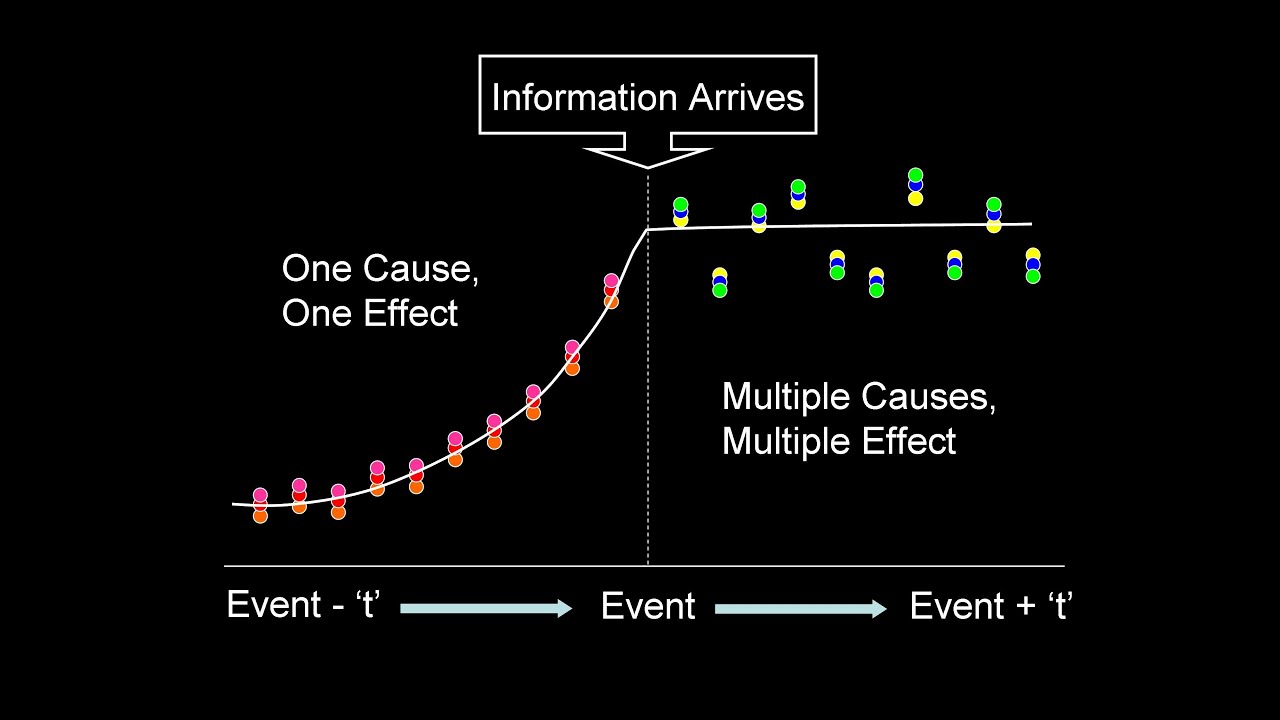

Event studies: Confirms Market Efficiency or Behavioral Anomalies?Over 10 million scientific documents at your fingertips Switch Edition Academic Edition Corporate Edition.